Investing in the financial markets is often a challenging experience and, so far in 2019, that has definitely been the case. Most bond managers have kept their focus on the dramatic decline in interest rates around the world. Much has been said about the level of low interest rates since the Financial Crisis, but this time last year the consensus was that the economy and central banks were finally in a position to encourage interest rates to rise in North America. This was the subsequent challenge for me as clients hold bonds in their portfolios for diversification, and of course, bonds provide a safety net in case the markets decline. As a reminder, when interest rates rise bonds decline, and vice-versa!

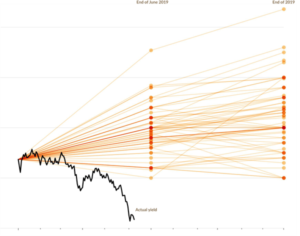

At the beginning of 2019, The Wall Street Journal surveyed economists to predict where interest rates would be in June and December of 2019.

As you can see from the chart, not one of them came close to predicting the dramatic decline in rates and there is no reason to believe that their forecasts will fare any better at the end of the year.

I’ve seen similar results posted for economists trying to predict the future price of oil or currency rates, and each time the result is basically the same. Forecasting the future is hard and humans are generally very bad at it.

The good news is as bond and treasury yields have been declining globally, the bond component of our portfolios have increased in value which bodes well for our performance. However you must still keep in mind there continues to be risks in the market, trade wars, tariffs, slowing global economy, late-stage market and economic cycle, and political uncertainty. I continue to emphasize the importance of income producing investments, namely bonds, and dividend paying securities. This will help mitigate downside risks yet continue to reward us while we hold them!